Knowledge

08.12.2023 Performance of gemstones: a brilliant investment

Natural-colored, untreated gemstones are an attractive investment option due to their increase in value or stable value. But how much is a gemstone purchased 10 years ago actually worth today? We take a closer look at the performance of rubies, sapphires and emeralds.

Untreated colored gemstones as a long-term investment

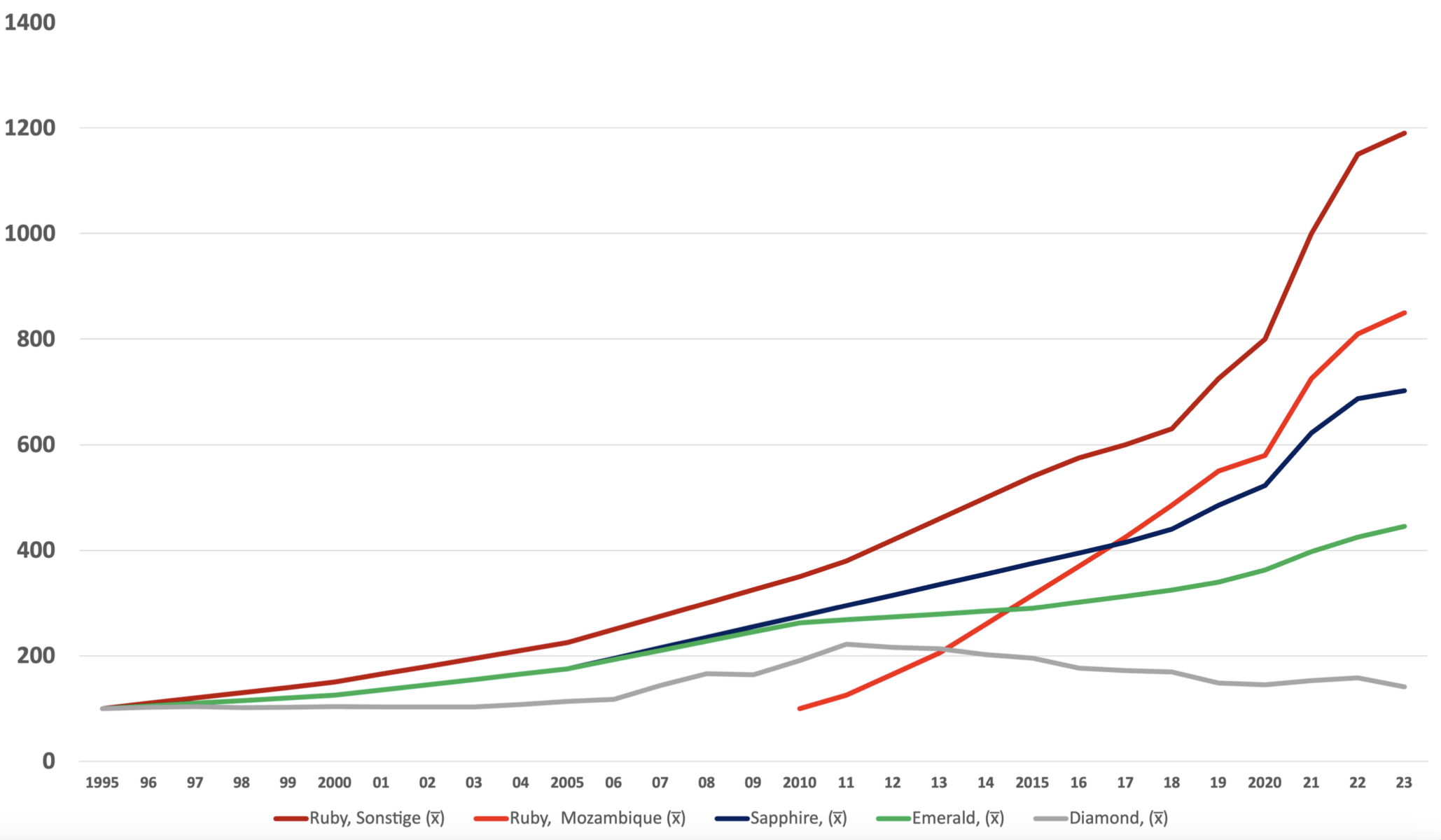

Since 1995, market prices for natural-colored, untreated colored gemstones have at least tripled. Ruby can even boast an incredible increase of 1200%.

© The Natural Gem 2023 | Sources: Rapaport Diamond Report, Gemval Aggregate Index (GVA), Sukrup Gem Index (SGI), Finanzen.net | own representation

Gemstones are not considered volatile and show a continuous increase in value.

Compared to other forms of investment, the appeal of investing in gemstones lies in their stable performance. They show hardly any volatility and have always proven to be a safe investment in times of economic uncertainty. Unlike gold, for example, the range of fluctuation in value is much smaller. Although every form of investment involves a certain amount of risk, neither rapid increases nor significant losses in value are to be expected with gemstones.

An investment in gemstones is therefore not speculative in nature. The jewels are ideal for preserving value, and their compact size makes them very mobile, easy to store and their value density is impressive.

Of course, gemstone investments do not generate regular income like investments in shares, bonds or real estate. It takes time to achieve profits with gemstone treasures – but they are all the more certain. An investment horizon of at least 10 years is recommended for these precious tangible assets so that investors can benefit from the continuous increase in value.

In addition to the time aspect, the choice of gemstones is also decisive: only natural-colored, untreated colored gemstones of the highest quality are suitable for increasing value. Certificates from internationally recognized, independent laboratories prove whether a stone has been treated and determine its quality based on the 4 Cs. The big three – ruby, sapphire and emerald – are particularly suitable for investment.

Increase in value of ruby, sapphire and emerald in the last 10 years

We have taken a close look at the price performance of rubies, sapphires and emeralds from 2013 to 2023 and show the exemplary performance of three gemstones in different sizes over 10 years:

Increase in value of a ruby

Let’s assume that 10 years ago you bought an untreated ruby from Mozambique with a weight of 3.577 ct., very good color quality (III) and only very small inclusions (C). 10 years ago, you could have bought the ruby for €12,307 gross.

From 2013 to 2023, the value of rubies from Mozambique increased by 550% (calculated on the net price). This means that you could sell the gemstone today for around €66,666 (as a private investor, you sell at the net price without having to pay VAT) and would have made a profit of €54,359 – despite the 20% VAT you paid in 2013. As an added bonus, there is no income tax on the profit in Austria and Germany if you have owned the gemstone for more than one year. This corresponds to an annual return of 18.41% (taking into account the compound interest effect).

Value enhancement sapphire

Next up is an untreated oval-cut blue sapphire weighing 6.142 ct. The color quality of the gem is classified as “Good” (IV) and it has only very small inclusions (C). The price of the gemstone 10 years ago would have been around €13,571 (gross), net €11,309.

Since 2013, the value of sapphires has risen by around 250 %. This means you could sell the gemstone for €39,583 today. You would have made a profit of around €26,000. This corresponds to an annual return of 11.24% (including compound interest).

Emerald value enhancement

Our third stone is an emerald from Zambia. The gemstone weighs 1.477 ct, has a very good color quality (III), small inclusions (D), was cut in an octagon cut and is certified as “Minor” with regard to treatments (in this case oiling, otherwise no treatment). In 2013, you could have bought the stone for €3,875 (gross), net €3,229.

In the last 10 years, the value of emeralds has risen by 60 %. So today you could sell the gemstone for €5,167 net and make a profit of €1,292. This corresponds to an annual return of 2.92% (taking into account the compound interest effect), which would still exceed the annual inflation rate and the interest you would have earned on a fixed-term deposit or government bonds over the last 10 years. And all this with very low volatility and manageable risk.

Conclusion: Gemstones as a crisis-proof & rewarding investment

As our exemplary calculation shows, gemstones increase in value considerably over the years – the performance is significantly better than that of gold, for example. An investment in this form of tangible asset not only secures your wealth, but also increases it. In times when interest-bearing products are not yielding any returns, gemstones are an excellent addition to an existing investment portfolio. They compensate for the negative effects of inflation and show a stable, positive performance.

An investment in colored gemstones protects and increases your wealth.