Knowledge

31.10.2022 Insurance for your gemstones

Anyone who purchases gemstones or jewelry is also concerned about how to adequately insure them in the event of loss or theft. The first step is to keep all documents related to a gemstone or piece of jewelry well and secure – invoices, certificates, appraisals and documentation such as photos or reports. But the second step is to make sure that the valuables are also covered by an insurance policy.

Are gemstones covered in your household insurance policy?

Valuables are included in many household insurance policies, but the compensation for damages under these policies is usually only a few thousand euros.

Investment-grade gemstones, heirlooms and other high-value possessions should therefore be insured additionally. For this purpose, insurers offer separate policies for insuring valuables (which may include fur coats, for example), also called valuables insurance policies.

What do you need for the insurance of gemstones?

Insurance companies insist on presentation of the certificate in order to insure a gemstone.

An appraisal of the gemstone by an appraiser or a gemstone certificate is a prerequisite for insurance. Certificates for gemstones from independent gemological laboratories are essential for determining the authenticity, treatments and ultimately the value of the stone. The appraisal or certificate for insurance should show the so-called retail replacement value, which is the price a consumer would have to pay for the piece in a jewelry store (including VAT). In addition, some insurers also require an invoice for the purchase.

Certificates, invoices and other documentation related to gemstones must always be kept separately from gemstones for additional protection. In addition, it is also advisable to carefully store digital copies of these documents in order to be able to access them quickly in case of an emergency.

What to look for in gemstone insurance?

When obtaining quotes for gemstone insurance, you should carefully consider the following points:

- What all is needed for the insurance, what documents, photos, etc.?

- What price or value will be used as a basis? It is possible that the replacement value, the purchase price as well as the market value, time value or material value is used.

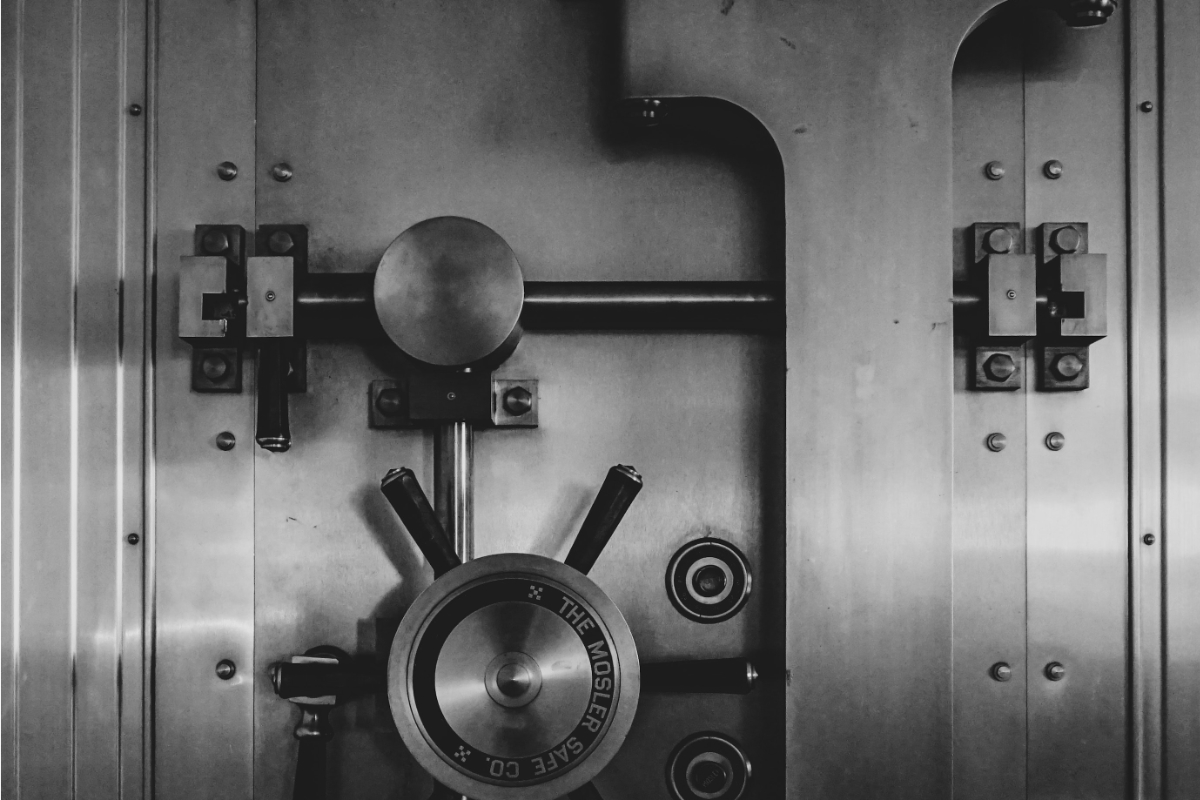

- What are the storage conditions according to the insurance? For example, are locked containers (with a simple lock) necessary, is open storage (in showcases) also insured, or are protective containers such as safes prescribed?

- How is the transport taken into account in the insurance policy? Is transportation covered, who is allowed to transport the gems (only the owner?) and in which containers?

- How is value adjustment handled to avoid under- or over-insurance? It is advisable to have appraisals renewed at regular intervals (about every three years) and to have the insurance policy updated.

Choosing the right insurance for your gems

If you are looking for an insurance company yourself, you should already contact them before getting an appraisal, as insurance companies usually only accept certain selected appraisers for valuables. The Natural Gem also puts its clients in touch with reputable insurance companies where they can get quotes for both carry and vault insurance.