Knowledge

17.08.2023 Investment in gemstones for beginners: tips for getting started

Gemstones are not only beautiful to look at, they also offer several advantages that make them an attractive investment option. In this article, we will familiarize you with the basic principles of investing in gemstones and teach you how to choose the right gemstones for your investment strategy and build a profitable gemstone portfolio. With our tips, you can fully realize the potential of this unique asset class.

Why invest in gemstones?

Gemstones have not only enjoyed great popularity in recent years, but have been used as an investment for more than 5,000 years. And for good reason:

High concentration of value in the smallest of spaces

Gemstones are compact and offer a high concentration of value. They are easy to store, transport and pass on. This makes them an attractive option for long-term wealth planning and preservation.

High stable value

Gemstones have proven their worth as an investment for thousands of years. They have survived crises, wars and economic upheavals without losing value. Unlike gold or stocks, gemstones have low volatility and are considered to retain their value.

Gemstones are small, light, stable in value and are traded internationally.

Strong increase in value

Due to high demand and declining mine yields, natural-colored gemstones in particular are showing a steady increase in value. Auctions, where many a gem is sold at record prices, also drive prices. For example, rubies have increased in value by over 8% per year over the last 25 years.

Low correlation with other asset classes

Because gemstones have a low correlation to other investment classes such as stocks and bonds, they are an excellent way to diversify the investment portfolio and thus spread risk.

For whom is an investment in gemstones suitable?

Gemstones as an investment are recommended for investors who already own other types of investments and want to diversify their portfolio by investing 10-20% of their liquid assets in the sparkling tangible assets.

In addition, an investment in gemstones is suitable for people who are interested in long-term capital accumulation. This is because gemstones as an investment in value are by no means a speculative investment. As a long-term investment, a time horizon of at least 5 years is recommended.

Which gems to invest in?

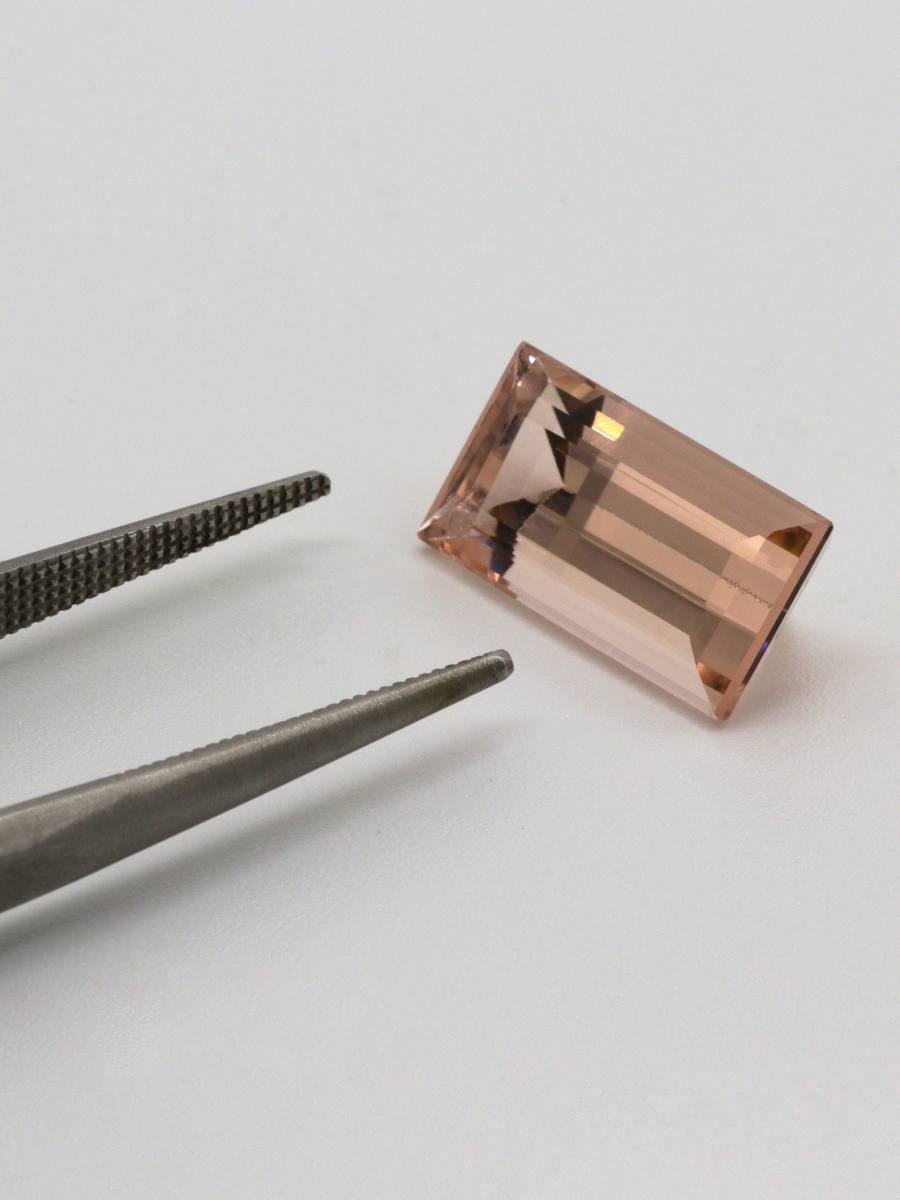

Investment gemstones are natural colored, untreated stones of high quality. In other words, stones whose color or purity have not been artificially altered. “Untreated” does not mean, however, that the stones have not been cut, but that no treatment has been applied beyond cutting (such as heating, firing, or irradiation).

For starters, the big three are ruby, sapphire and emerald. An investment in rare stones such as alexandrite, tanzanite or tourmaline is more recommended for people who already own gemstones – for an existing gemstone portfolio, they are an excellent addition.

The value of diamonds has declined since the 2008 financial crisis. However, with an investment horizon of at least 20 years, they are also interesting – especially colored “fancy diamonds”, which are very rare and accordingly valuable.

What to look for when investing in gemstones?

Not only the type of stones (see above), but also their quality and authenticity must be considered when investing in gemstones. The former is determined by four quality criteria – the so-called 4 Cs: Carat (weight), Color (color), Clarity (clarity) and Cut (cut). Only high quality gemstones are suitable for investment.

The authenticity of a gemstone can hardly be determined by laymen – a qualified expert with full laboratory equipment should do the authenticity determination. The Natural Gem only sells gemstones with internationally recognized, independent certificates attesting to the authenticity of the gem.

Last but not least, the stone should please you and its sparkle should bring you joy. When buying an investment-quality gemstone, choose a stone that speaks to you, so to speak, and whose beauty will convince you!